Equesure Terms of Business Arrangement and Important Information

This document sets out the key terms and information you need to know about us, and our arrangement with you. Please read it carefully. If you do not understand any point or have any questions regarding our relationship with you, please ask us for further information.

Accepting of our Terms of Business

By asking us to quote for, arrange or handle your insurances, you are providing your informed agreement to these Terms of Business.

Who are we and who regulates us?

In these terms of business “we”, “us” and “our” means Equesure, a trading name of Insurance Factory Limited. We are an insurance intermediary who are based in the UK and are authorised and regulated by the Financial Conduct Authority. Our registration number is 306164 and you can check our status by visiting the FCA’s website https://www.fca.org.uk/register. We are registered in England and Wales (no. 02982445) and our registered address is Markerstudy House, 45 Westerham Road, Sevenoaks, Kent, TN13 2QB. Insurance Factory Limited are a wholly owned subsidiary of the Markerstudy Group which also includes Markerstudy Insurance Services Limited.

About Our Services

We are an insurance intermediary who arrange Horsebox, Horse Trailer, and Horse Insurance policies. We also offer a select range of optional additional products alongside our policies. We will arrange your insurance cover, administer payment or refund of premiums collected from you and pass them to the insurer and help you with any changes required to your existing cover. When arranging your cover, we will ask you questions so we understand your needs and ensure we provide you with a product or choice of products which meets those needs. Where more than one product on our panel is identified which meets your demands and needs, we will offer you the cheapest of those products. We do not provide advice or recommendations but will provide information about relevant products for you to make an informed decision. Please ensure that your policy meets your demands and needs.

Throughout the period of insurance, we act on behalf of both you and the insurer. We act on behalf of you when providing a quote and arranging cover. Where we issue policy documents, handle claims, and collect or refund premium payments, we act on behalf of the insurer.

Our Fees, Taxes and Charges

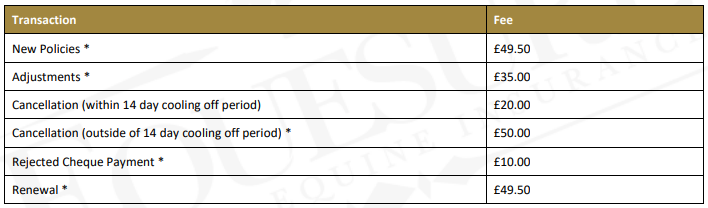

When you take out a policy with us you will be informed of the total price to be paid, including any fee, taxes and charges. This will be confirmed before we conclude the sale with you and with details also provided in your welcome letter. Any fees, taxes and charges that apply on renewal of your policy will be confirmed in your renewal invitation. A range of other fees also apply to your policy, which will be chargeable at the point they apply. A summary of these is provided below:

Please note:

• Any changes you make to your policy can also increase or decrease your insurance premium. Some insurers may also charge fees for making changes. Details of these can be found in your policy terms and conditions.

• Some fees are non-refundable after the first 14 days. These are highlighted with an asterisk (*) above.

• All premiums quoted include the government’s Insurance Premium Tax (“IPT”) at the prevailing rate.

Remuneration

When you arrange or renew your policy through us, we charge you a fee, the amount of which is confirmed in your premium breakdown and welcome letter. In addition, we receive commission, which is a percentage of the premium, from the insurer(s) of your policy and any additional optional products you have purchased.

If you choose to purchase your policy using premium finance, we will also receive commission from the finance provider for arranging the finance. We will be happy to provide details of this upon request.

We remunerate our colleagues using a combination of fixed and variable rewards that are designed to ensure they always act in the customers best interests. Our sales and servicing colleagues receive variable financial and non-financial rewards based on their sales performance, providing they also achieve high levels of customer service and quality scores.

About The Products We Offer

We are not contractually obliged to place business with specific insurers, but arrange Horsebox, Horse Trailer, and Horse Insurance policies through a select panel of insurers and other intermediaries including Allianz, Markerstudy Insurance Services Ltd, KGM, Peliwica, South Essex Insurance Brokers (SEIB) and Equity Red Star (ERS). Our optional additional products are provided by one insurer per product. For Horsebox and Horse Trailer Breakdown and Recovery insurance we can only offer products from RAC Insurance Limited & RAC Motoring Services Limited, for Horsebox Legal Expenses insurance we can only offer products from RAC Insurance Ltd and for Equine Excess Protection Insurance we can only offer products arranged by Sparta Insurance Service Group

LTD.

Please note if your policy start date or renewal date was before the 28th June 2024 your Breakdown cover will be provided by ERS (Equity Red Star).

Your Responsibilities

Please take reasonable care to answer all the questions we ask you, either over the phone or online, honestly and to the best of your knowledge. If you do not your policy may be cancelled, treated as if it never existed or your claim not fully paid. For Horsebox insurance, we would like to remind you that it is an offence under the Road Traffic Act to make any false statements, or withhold any relevant information, to obtain a Certificate of Motor Insurance. Please note that under the Rehabilitation of Offenders Act you are not required to disclose convictions regarded as ‘spent’.

You must also tell us about any changes which affect your insurance policy, for example a change of address, or a change in vehicle.

Full details of the things you should tell us about are provided in your policy documents.

It is your responsibility to ensure that you have read, understood, and checked the accuracy of the documents we send you, including details of the cover, limits and other terms that apply and confirmation of the information you have provided. If there are any errors, or you have any questions about your policy please contact us for assistance.

Cancellation

If you want to cancel your policy, please contact us using the contact details provided with your policy. The charges which will apply for cancelling your policy, and how any refund is calculated are set out below.

Cancelling within the first 14 days

- If you cancel your policy within 14 days of the purchase date or the date at which you receive your documents (if this is later) then:

- If your policy has not started, we’ll refund your full premium minus a £20 cancellation fee.

- If your policy has started and you have not made a claim, we’ll refund you minus a deduction for the time on cover (calculated as a proportion of the annual cover based on the insurers cancellation terms) minus a £20 cancellation fee.

- If your policy has started and you have made a claim it is likely that none of your premium will be refunded.

- If you purchased optional extra products and cancel your main insurance policy, any optional extra products purchased will also be cancelled with a full refund, provided you have not used the product or claimed.

In all cases our cancellation fee set as set out above will apply.

Cancelling after 14 days

If you want to cancel your insurance policy after the first 14 days then the cancellation will be subject to the insurers published cancellation terms in determining what, if any, refund is provided. These cancellation terms can be found in the Insurance Product

Information Document and/or policy terms and conditions and we recommend you read this carefully to ensure you understand what terms will apply. If you have made a claim, it is likely that none of your premium will be refunded.

In addition to the insurers terms our cancellation fee of £50 will apply, the arrangement fee for setting up the policy will not be refunded and any discounts which were applied to the original premium will be deducted on a pro-rata basis. We will also retain a proportion of the commission we received for arranging your policy.

In the event of cancellation of your main insurance policy after 14 days, any optional extras you have purchased with your insurance will be cancelled at the same time (whether or not they are included in your main policy or covered under a separate policy), and their premiums will not be refundable.

If your policy start date or renewal date is on or after the 28th June 2024 and you have purchased RAC Breakdown cover you will receive a pro-rata refund of premium if no claims have been made in the event of cancellation of your main policy.

Discounts may be given against the total cost of your policy. If we have given you a discount against your premium, this will be deducted on a pro rata basis from any refund due to you on cancellation.

Refunds

If you are entitled to a refund for any reason after your policy has started or after the expiry of 14 days, we will only provide this where the amount due to you is greater than £10.

Policies cancelled by us or the insurer.

If your policy is cancelled by us or the insurer, for reasons such as misrepresentation, failure to disclose or failure to make payment, we will give you 7 days’ notice of the cancellation. The cancellation will be treated in line with the terms above.

Avoidance of Contract

Where we are instructed by your insurer to avoid the contract of insurance from inception, we will retain the arrangement fee to cover our administration costs.

Paying by Direct Debit

If you choose to pay by Direct Debit, you will be taking out a premium finance arrangement which is financed by Close Brothers

Premium Finance (CBPF). We receive commission from the finance provider for introducing you to them and will be pleased to provide this information upon request. CBPF will send you a welcome pack which will include a credit agreement. In assessing your application CBPF will search the public information a credit reference agency holds about you. The credit reference agency will add details of the search to their records whether or not the application for credit proceeds. This and other information may be used to make credit decisions about you and to undertake checks for the prevention and detection of money laundering.

When paying via Direct Debit, you will be responsible for paying the monthly instalments as they fall due. In the event of any due payment not being made, the overdue payment must be made immediately. A missed payment charge will be incurred for any failed Direct Debit payments. If the payment is not received within 7 days of the default, we will commence the cancellation procedure in accordance with the policy conditions.

If you pay for your insurance policy premiums by monthly direct debit and have a claim, you are required to continue paying your monthly direct debits or settle the outstanding balance in full. Failure to do so may result in the insurer exercising any rights it has including the possibility of any claim not being settled by the insurer until payment for the policy has been received in full.

Automatic Renewal

To make the renewal process easier we may offer you the option to arrange for your policy to renew automatically. Where this is the case, the payment for the policy will be taken by the same method as the previous year and we will always write to you before the renewal is due to confirm the policy is due to renew automatically and give you the chance to cancel the renewal. Where your policy is set-up to automatically renew this will be confirmed in your welcome and/or renewal pack and you can opt out at any time by contacting us.

Receiving your Documents

We are committed to reducing our carbon footprint so our standard practice is to e-mail your documents to you, however, documents can be issued by post if required, just let us know.

Handling Money

We act as agent for the insurer for the collection and payment of your premiums including any optional additional products you choose to purchase. This means that your premiums are treated as being received by the insurer when they are received by us.

Any premium refund is treated as being received by you when it is actually paid to you. We will not pay you the amount of any interest that we earn from investing your money before paying it to your insurer.

If You Need to Complain

At Equesure we are dedicated to treating you fairly and responsibly. However, occasionally things can go wrong. If you experience an issue, please contact us by telephone on 01480 220089 or email at contactus@Equesure.co.uk you can also write to us at Equesure, Lancaster House, Meadow Lane, St Ives, Cambridgeshire, PE27 4ZB. We will endeavour to resolve your complaint by the end of the 3rd working day following its receipt, however where this is not possible, we will send you a written acknowledgement within 5 working days. This will confirm who is handling the complaint for you.

Wherever possible we will then resolve your complaint within 4 weeks. If this isn’t possible, for example because we need information from another party, we will write to you to confirm this, and advise when we expect to provide a response.

When we have fully investigated your complaint, we will confirm our final response in writing. This will usually be within 8 weeks of you making your complaint. In the unlikely event that we are unable to provide this within 8 weeks we will write to you to explain why, and when you can expect our final response.

If we have taken longer than 8 weeks to respond, or you remain dissatisfied with our final response, you can contact the Financial Ombudsman Service (FOS) within 6 months of the date of our response. They can be contacted in writing at The Financial Ombudsman, Exchange Tower, London, E14 9SR, by telephone on 0300 123 9123, by email on complaint.info@financialombudsman.org.uk through their website at www.financial-ombudsman.org.uk.

The FOS will consider your complaint impartially and we are bound by their decision.

Financial Services Compensation Scheme

We are covered by the Financial Services Compensation Scheme (FSCS). You may be entitled to compensation from the scheme if we cannot meet our obligations. For compulsory classes the balance of any additional premium due. Any subsequent cancellation of your policy, by you or the insurer, will incur a charge as set out in the 'Administrative charges' section. of insurance, insurance advising and arranging is covered for 100% of any claim, without upper limit. Further information about compensation scheme arrangements is available on the FSCS website www.fscs.org.uk or by telephoning 0207 741 4100.

Applicable Laws

Unless specifically agreed otherwise, this insurance shall be subject to English Law, and the parties agree that any dispute arising out of it shall be subject to the non-exclusive jurisdiction of the English Courts.

Useful Contact Information

If you need to contact us about your policy, please use the details below:

• Customer Service including amendments and cancellation enquiries call 01480 220089 or email contactus@equesure.co.uk

• Renewals call 01480 220089 or email contactus@equesure.co.uk

• New Policies call 01480 220089 or email contactus@equesure.co.uk

• Claims call 01480 220089 or email contactus@equesure.co.uk

Your Data

How we use your information: It is important that you understand how we, as a Data Controller, use your personal data, this section provides you with some basic privacy information. For full details on how we use your personal data and what rights you have please visit our website www.equesure.co.uk where you will find a link to the Privacy Notice at the bottom of the page. You can also request a copy of our Privacy Notice by contacting our Data Protection Officer, details below.

Supporting Your Needs: We collect and share information about you and your personal circumstances to identify and support your customer needs and to ensure we meet our regulatory responsibilities. This data may include Special Category Data that assists us in identifying and providing additional support and assistance if needed, for example providing documents in an alternative format.

Fraud prevention and detection: We carry out fraud checks on our customers to prevent fraud and to help us make decisions about providing, pricing, and administering insurance. When we carry out these checks, we will search against fraud detection databases. We may pass details about you to some of these databases. Law enforcement agencies, financial service providers, fraud prevention agencies, police and other organisations may also access these databases.

Automated Decision Making: Some of our decisions are made automatically by a system or computer reviewing your data. You have a right to ask us to review any automated decisions.

Credit searches: Credit reference agencies are companies that collect, record, and monitor people’s credit history. We share information with credit reference agencies to assess applications, verify your identity and address and to obtain information about historic payment behaviour. We do this to help us to prevent fraud and carry out risk profiling, which allows us to calculate affordability, product suitability and creditworthiness. The credit reference agency we partner with will be a Data Controller in their own right.

Your rights as a data subject: Under Data Protection Laws, you have certain rights, if you would like to exercise any of your rights, please contact our Data Protection Officer.

Data Protection Officer: If you have any questions about how we use your data please contact our Data Protection Officer at: Data Protection Officer, 45 Westerham Road, Bessel’s Green, Kent, TN13 2QB or dataprotection@markerstudy.com. You also have the right to complain to the Information Commissioner’s Office, which regulates data protection compliance. You can find more information by visiting their website www.ico.org.uk.